According to customs statistics, in the first quarter of 2013, my country's total export of medical dressings was US$507 million, a year-on-year increase of 1.76%, accounting for 12.3% of the export of medical devices (the total export of medical devices in the first quarter was US$4.115 billion). From January to March, the export value of medical dressings in my country fluctuated greatly, but the overall trend was on the rise.

The overall export situation of medical dressings from January to March has the following characteristics: First, the growth of export value is slow, but compared with the overall decline of 6.98% in 2012, the export in the first quarter has eased, but compared with 2011. More than 30% The average growth rate is still not optimistic compared to the situation. Second, the export of medical dressings is 12.78 percentage points lower than the 14.54% increase in the overall export of medical devices in the first quarter of this year, which highlights the lack of export growth momentum in the dressing sub-industry. Third, the traditional markets in Europe, America and Japan showed weak demand, and emerging markets in South America were the bright spots in the export market. Fourth, the prices of bulk commodities continued to fall amid fluctuations and tended to be stable, and the prices of exports dropped slightly. In general, affected by the overall foreign trade situation, the export of medical dressings is recovering slowly, and exports should seek new development momentum in emerging markets.

<1> The export volume in the first quarter remained at 169 million US dollars per month The large fluctuations in exports were mainly affected by the Spring Festival holiday, resulting in fewer shipments and lower export volumes.In the first quarter, the monthly export value fluctuated greatly. In February, it increased by 30% year-on-year, while in March, it fell by 16% year-on-year. The average export value basically remained at the level of 169 million US dollars per month. The large fluctuations in exports were mainly affected by the Spring Festival holiday, resulting in fewer shipments and lower export values. At the same time, the overall situation of foreign trade is severe, the exchange rate of RMB against the US dollar has risen rapidly after the year, competition in Southeast Asian countries, and the decline in product prices have lowered the export share and other factors that also affected the decline in exports.

<2> my country's exports to Europe increased by 2.39% year-on-year In the first quarter, exports to emerging markets in Latin America, in particular, increased by 40.69%.Europe and North America are the two traditional markets for our medical dressing exports. The two major market shares accounted for 65.76% cumulatively. In the first quarter of this year, the export value of my country's medical dressings to the European market recovered slightly, with a year-on-year increase of 2.39%, which turned from negative to positive compared with last year. The export value to North America fell by 4.14% year-on-year, which continued last year, showing a negative growth situation. The 4.78% year-on-year decline in exports to the United States was the main reason for the decline in North American exports. With the active promotion of the market diversification strategy, the growth rate of trade between China and emerging market countries is still relatively fast. In the first quarter, exports to emerging markets in Latin America, in particular, increased by 40.69%, of which exports to Venezuela and Brazil increased year-on-year. They reached 181.3% and 66.6% respectively.

In terms of country, among the top ten markets, the United States is the largest exporter of medical dressings in my country, accounting for nearly 1/3 of my country's entire export market. Many domestic export companies said that exports to the United States are still facing huge challenges. Domestic prices are rising rapidly, and labor, raw materials, and freight costs will increase accordingly. If low-value consumables production and foreign trade companies increase their prices accordingly, it will be difficult for overseas buyers to accept the purchase of products. In addition, the RMB has continued to appreciate recently, while India, Vietnam and other Southeast Asian countries have seized many customers in my country due to the devaluation of their currencies and reduced labor costs. For example, Vietnam and Cambodia squeezed about 30% of my country's low-value consumables last year. African customers.

<3> The export value of foreign-funded enterprises increased by 0.67% year-on-year

The export value of three foreign-funded enterprises is 280 million US dollars, of which wholly foreign-owned enterprises and Sino-foreign cooperative enterprises are the main ones.

In the nature of export enterprises, foreign-funded enterprises and private enterprises are the main ones for the export of medical dressings, accounting for 55.21% and 35.89% respectively. The export value of foreign-funded enterprises was 280 million US dollars, a year-on-year increase of 0.67%, of which wholly foreign-owned enterprises and Sino-foreign cooperative enterprises were the main ones. The export value of private enterprises in the first quarter was 179 million US dollars, a year-on-year decrease of 0.93%. The export value of state-owned enterprises, which accounted for 9.28% of the export value, increased by 20.55% year-on-year in the first quarter.

<4> The proportion of top 10 exports decreased by 0.5% year-on-year

The top 10 exports accounted for 27.1%, a slight decrease from 27.6% in the same period last year.

The market share of the top 10 exporting enterprises remained basically stable. In the first quarter, there were 5 enterprises whose cumulative export volume exceeded US$10 million, and 16 enterprises were more than US$5 million. Most of the top 10 exporters are production-oriented enterprises, and the top 10 exports accounted for 27.1%, a slight decrease from 27.6% in the same period last year. The competition pattern of export enterprises has basically remained stable, and the concentration needs to be further improved.

<5> Hubei Province's exports increased by 32.96% year-on-year

The three provinces accounted for 61.1%. In particular, the export value of Hubei, a major cotton-producing province, was US$105 million in the first quarter.

From January to March, the major export provinces of medical dressings are still Jiangsu, Hubei and Zhejiang. The three provinces accounted for 61.1%, especially Hubei, a major cotton-producing province, whose export value in the first quarter was US$105 million, a year-on-year increase of 32.96%. Other regions with faster export growth in the first quarter included Zhejiang, Anhui and Beijing.

<6> Exports of bulk commodities fell by 0.42% year-on-year

The export volume increased by 7.9% year-on-year, the price showed a downward trend, and the export price decreased by 7.71% year-on-year.

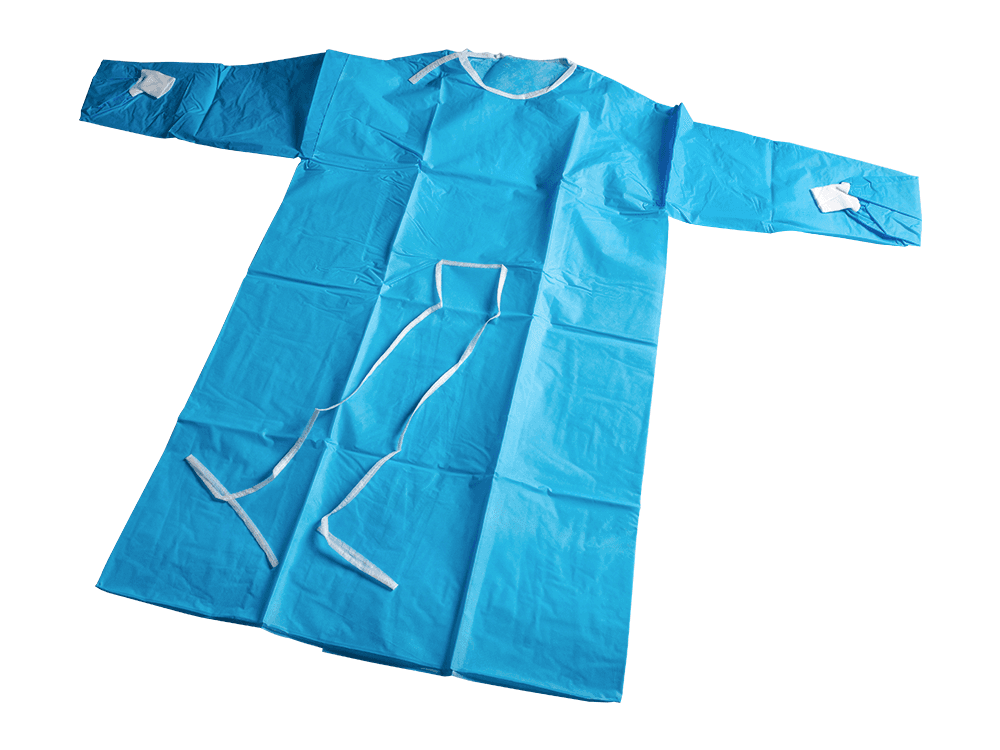

According to specific product categories, cotton wool, gauze and bandages are the bulk commodities for medical dressing exports. From January to March, the export value was 196 million US dollars, accounting for 38.60% of the dressing export. The price showed a downward trend year-on-year, and the export price decreased by 7.71% year-on-year. In contrast, the fastest growing export of products is the disposable or medical non-woven garments made of chemical fibers, which ranks second in terms of export value. The export value of such products is 138 million US dollars, an increase of 14.83% year-on-year, accounting for 27.33%. . Prices rose 0.4% year-on-year. Other products with a year-on-year increase in export value are adhesive plaster, other adhesive dressings and other articles with an adhesive coating, other soft fillers and similar articles.

<7> It is imperative to invest in high-tech products

The slow export growth in the first quarter was mainly affected by the off-season of shipments, and exports are expected to maintain steady growth in the second half of the year.

The slow export growth in the first quarter was mainly due to the impact of the off-season shipments, and judging from the fact that my country's medical dressings have occupied a relatively stable market share in the international market, exports are expected to maintain stable growth in the second half of the year.

The dominant position of my country's medical dressing products in the world will face multiple challenges: First, the price of raw cotton in my country remains high, which leads to the high cost of cotton used by medical dressing companies and the gradual loss of product price advantages. Under the support of the purchase and storage policy, the domestic cotton price has soared, which is about 93% higher than that of the United States and about 79% higher than that of India. According to industry analysts, the cost of domestic cotton will be higher than that of imported cotton in the next two to three years. However, due to the small volume of medical dressings, it is difficult to apply for cotton quotas. At the same time, the rising cost of water, electricity, labor and other aspects has weakened the price advantage of my country's products, and the economic benefits of enterprises, especially small and micro enterprises, have declined significantly.

Second, new materials such as non-woven fabrics, new viscose dressings and other products are more favored by modern medicine, and the competitive advantage of traditional cotton dressings in the market is gradually being replaced.

Third, the recent appreciation of the RMB exchange rate has frequently hit a new high. Since 2013, the RMB exchange rate against the US dollar has appreciated by 0.7%, of which the appreciation rate has exceeded 0.45% since April. For low-value-added medical dressing companies, the profit margin is offset by the appreciation of the RMB. Most of these companies are small and medium-sized enterprises with limited funds and weak ability to resist risks. Therefore, the appreciation of the renminbi has put pressure on export enterprises, but it will also guide enterprises to increase investment in high-tech products in order to increase the added value of products.

Fourth, recently, due to the devaluation of currencies in Southeast Asian countries such as India and Vietnam, the labor cost has been reduced, which has seized a lot of customers. In addition, the demand in the two core markets in Europe and the United States continued to be low, and the recovery did not improve, which directly led to a decrease in the export of dressings. In addition, the problems of low-level repetitive construction and homogeneous competition in the industry are still prominent, and the lack of more independent brands and marketing channels makes it difficult for enterprises to grasp the initiative in bargaining. These factors are the reasons for the slow growth in the export value of medical dressings.

english

english 中文简体

中文简体